6 Credits and Deductions Students Don’t Want to Miss Out On!

College and university is expensive! On average, Canadian students pay $6,400 per year for tuition alone. When you factor in textbooks, living expenses, transportation, medical expenses, debt repayment, and all the other price tags attached to student life, it’s easy to feel overwhelmed.

With the beginning of the fall semester just around the corner, it’s time for you to get proactive with saving money. You’ve probably heard the same old penny pinching tips a thousand times, but are you aware of the credits and deductions you can claim on your personal tax return?

1. Tuition and Textbooks

The tuition tax credit reduces the tax you pay on your income, and generally, any post-secondary course you take qualifies. To calculate the amount you will save, take the tuition fees you paid for that calendar year, and multiply by the lowest federal tax rate percentage, 15%. For example, if a student pays $6,400 tuition per year, then they are entitled to $960 in tax credit.

To claim your credit, your institution will send you your T2202 tax form, allowing you to enter your information on line 32300 of your tax return. The form certifies your eligibility for the tuition, so you’ll want to keep it in case the CRA wants supporting documentation for your claim.

You will also need to complete and file the Schedule 11 form, the Federal Tuition, Education, and Textbook Amounts and Canada Training Credit.

Did you know that the unused portion of your tax credit can be transferred to a family member or carried forward and claim in the future?

2. GST/HST Credit

The GST/HST credit is a tax-free payment where you’ve automatically applied, as long as you filed your taxes! The payment is quarterly, and you can expect to receive it on the 5th of July, October, January, and April. The amount you receive is based on your income, marital status and family size. For a single person with no children, the maximum credit is $456, which you qualify for if your net income is between $20,000 and $35,000. Don’t worry if you’re not in that bracket, because even f you have an income of $0, you are still entitled to the base amount of $299.

3. Scholarships Exemptions

If you qualify as a full-time student in the current, previous or next tax year, you will not be taxed on the income you received through scholarships, awards, bursaries or fellowships.

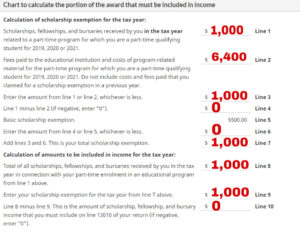

Part-time students get partial exemption, equal to the tuition paid plus the cost of the program related materials. There are a few calculations you’ll have to do to figure out how much income to include on Line 13010 (Scholarships, fellowships, bursaries, and artists’ project grants). This chart helps you with the calculation, and to give you an idea of how much income you might be exempt from declaring, we’ve included an example below. In this case, the part-time student does not have to include any of their aware income on their tax return.

4. Interest Paid on Student Loans

You might be eligible to claim the interest you paid on your student loan in the current tax year, as well as the preceding 5 years. If you received your loan under the Canada Student Loans Act, the Canada Student Financial Assistance Act, or a similar provincial/territorial government law, you can reduce the tax you have to pay by 15%.

With that being said, you’ll want to watch out for the restrictions on the kind of loans that qualify. You can’t claim interest from personal lines of credit or loans from foreign banks, and you can’t claim interest if you combined qualifying and non-qualifying loans.

Make sure you’re only claiming the interest if you have taxes to pay for the year, otherwise, you can carry the interest forward and apply it to any return in the next 5 years. Remember, it can be carried forward, but unlike the tuition tax credit, it’s not transferable to family members.

5. Canada Employment Amount

The Canada employment amount lets you claim $1,245 or the total employment income you reported if you made less than the full amount. You can use this credit to reduce the tax you have to pay. The purpose of this tax credit is to recognize work related expenses in the public and private sector. Unfortunately, you are not eligible if you’re self-employed.

6. Canada Training Credit

For the most part, we’ve been dealing with nonrefundable tax credits – credits that reduce the tax you pay, but you don’t actually get to keep the difference. With the Canada training credit, you get a refund for whatever is left over after your tax owning is reduced to zero.

The credit is calculated by adding half of your eligible tuition and fees paid for that year, to your Canada training credit limit for the taxation year (250$). So if you’re paying $6,400 for tuition, you’re entitles to $3450, in refundable tax credits!

Final Thoughts

There’s a lot of money to be saved and gained through filing your tax return. Nonrefundable credits can reduce the taxes you have to pay to zero, and the refundable ones can turn into money in your pocket. You should take advantage of every credit, deduction, and expense you’re eligible for—you deserve to maximize your tax savings.

If you want an optimized personal tax return for 2021, Contact us or book your FREE introductory meeting now to discuss your tax and accounting needs!